arkansas estate tax statute

Disposition of property to avoid assessment. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes

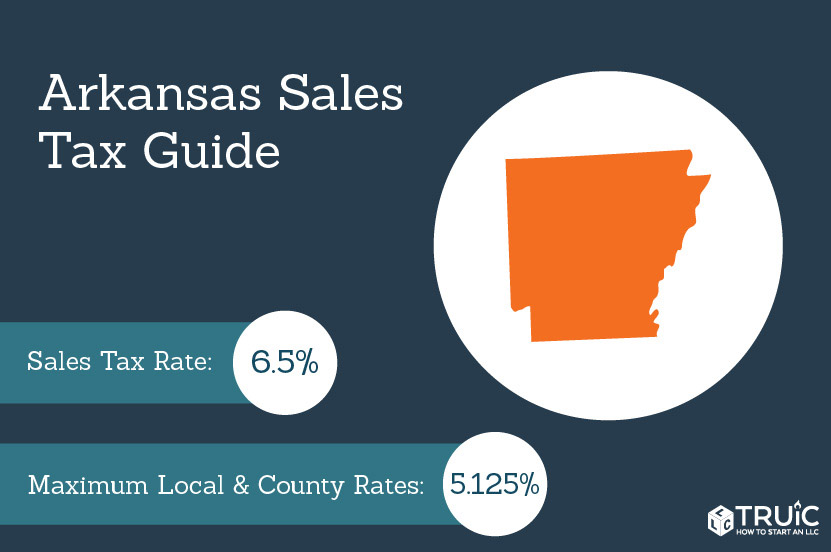

Sales and Use Tax.

. Generally Arkansas is a low tax state as indicated by the lower percentage of property taxes compared to total revenue collected. Pay-by-Phone IVR 1-866-257-2055. Affidavit of Compliance Form.

This includes Sales Use Aviation Sales and Use Mixed Drink Liquor Excise Tourism Short Term Rental Vehicle Short Term Rental Residential Moving Beer Excise and City and County Local Option Sales and Use Taxes. The tax is calculated based on 20 of the market value of real and personal property and the average annual value of merchants stocks andor manufacturers. Select Popular Legal Forms Packages of Any Category.

Online payments are available for most counties. The states adverse possession law for instance allows individuals with no official ownership stake to claim ownership of an otherwise underutilized property after seven years if the possession is. If you make 70000 a year living in the region of Arkansas USA you will be taxed 12387.

Of all taxes collected in Arkansas state and local combined 181 percent comes from property taxes. The full text of Act 141 can be accessed HERE. The State of Arkansas does not have a property tax.

All Major Categories Covered. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Welcome to FindLaws section on Arkansas property and real estate laws covering statutes that govern the landlordtenant relationship homestead protection from creditors and more.

When a property owner fails to timely pay the assessed tax the property may become subject to sale by the State. Arkansas Property Tax Statutes 26-2-107. Transfer Stamp Change Request.

However Arkansas cities and counties do collect property tax which is the principle local source of revenue for funding public schools. If any person for the purpose of avoiding listing for the payment of taxes on any property subject to taxation shall sell give away or otherwise dispose of the property under or subject to any agreement expressed or implied or any understanding with the purchaser done or recipient of. These 5 and 10 caps do not apply to.

The amount of taxes due annually is based on the assessed value of the property. 2001 et seq as in effect on January 1 2002 for estate. Homestead and Personal Property Tax Exemption.

Our two neighbors without income taxes Tennessee and Texas rely much more on property taxes. Property taxes paid to the county government are a major source of local government funding and are due on October 15 each year. According to Amendment 79 the taxable value cannot exceed.

Arkansas military retirement pay is exempt from state taxes. Home Excise Tax Miscellaneous Tax Real Estate. Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws.

Your average tax rate is 1198 and your marginal tax rate is 22. Real Property Transfer Tax applies to transferring ownership of mineral rights. The average homeowner pays 640 for every 1000 of home value in property taxes.

Section 26-59-107 - Tax imposed - Nonresident estates a A tax is imposed upon the transfer of all real tangible and intangible personal property located in the State of Arkansas of any nonresident of this state in a sum equal to the proportion of the federal credit allowable under the federal estate tax laws 26 USC. Limit for Other Properties eg commercial vacant or agricultural 5 a year until the propertys full assessed value is reached. However the figure fluctuates from county to county.

Act 141 of Arkansas 91 st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes effective 1 January 2018. Thats the fifth lowest in the nation where the average is 31 percent and lower than all our neighbors roughly equal to Oklahomas. The average Arkansas property tax bill adds up to 890.

Arkansas Income Tax Calculator 2021. 10 a year until the propertys full assessed value is reached. Arkansas disabled veterans who have been awarded.

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Legislators File Bill To Exempt State Taxes On Unemployment Compensation

10 New Laws To Know About In 2022

Arkansas Governor Signs Accelerated Tax Cuts School Safety Funding Into Law

Arkansas Inheritance Laws What You Should Know

Arkansas Sales Tax Small Business Guide Truic

Eliminating Its Income Tax Will Help Arkansas S Economy

Planning Family Forests How To Keep Woodlands Intact And In The Family By Thom J Mcevoy 2013 Trade Paperback Large Type Large Print Edition For Sale On Woodlands Large Prints Forest

Eliminating Its Income Tax Will Help Arkansas S Economy

The Ultimate Guide To Arkansas Real Estate Taxes

Guide To Arkansas Closing Costs In 2021 Newhomesource

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

Arkansas State Tax Guide Kiplinger

Arkansas Tax Rates Rankings Arkansas State Taxes Tax Foundation

Recreational Land For Sale Cherokee Village Arkansas 72529 Price 950 In 2022 Cherokee Village Land For Sale Lots For Sale